Biden created the student debt crisis he claims to solve

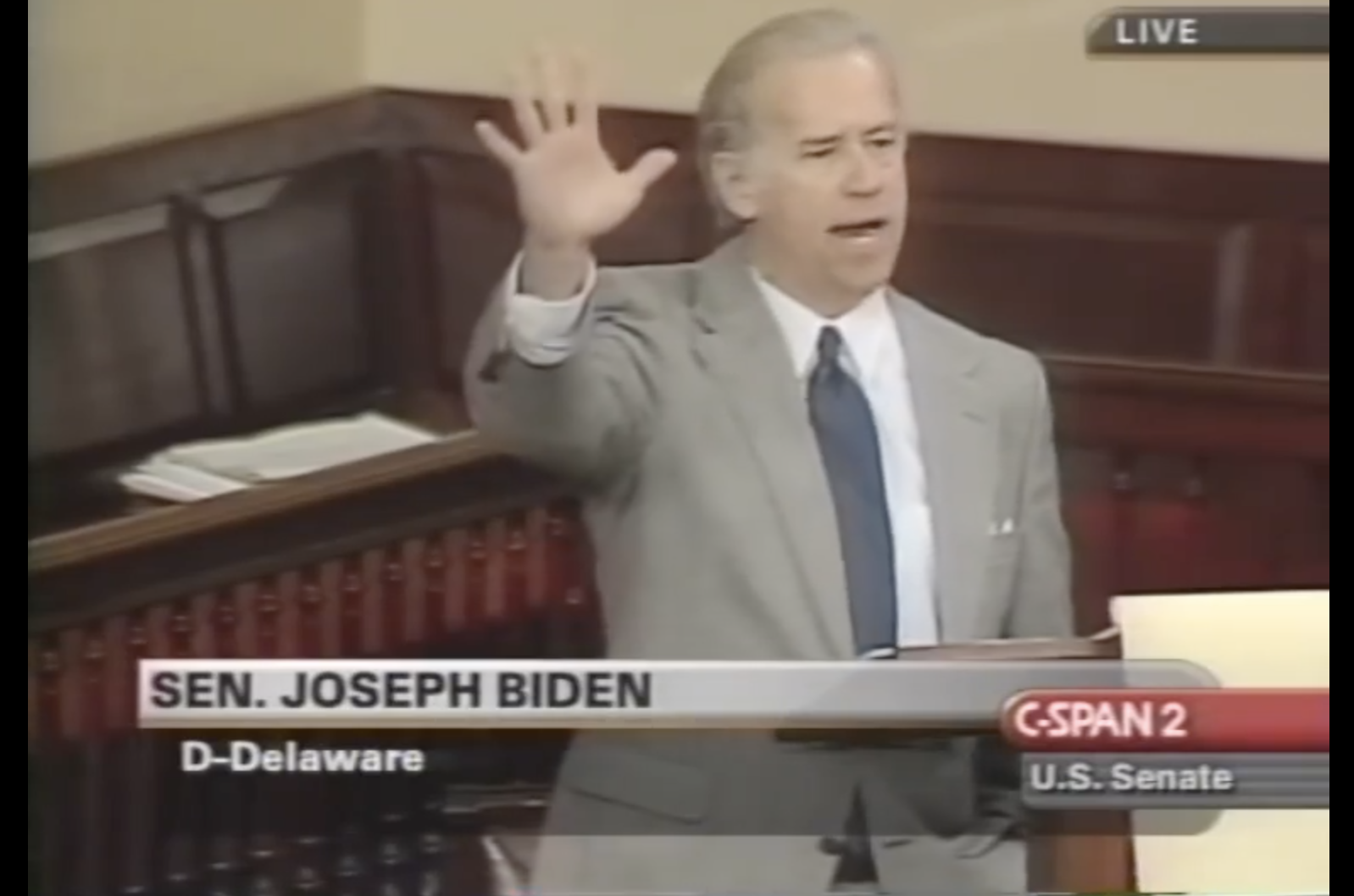

There are plenty of problems with Biden’s student debt cancellation plan — morally, economically, and legally. The plan is fundamentally unfair; many experts think it will be inflationary, and it’s almost certainly illegal under Supreme Court case law. But that’s not the whole story: As a senator in 2005, Joe Biden pushed changes to bankruptcy law on behalf of the credit card industry that helped precipitate the debt crisis. student.

Pre-Biden Bankruptcy Laws

There is indeed a student debt crisis. About 45 million Americans owe something like $1.6 trillion in student loans. Most of the debt is owed to the government. But a significant share (about 8%) is due to private lenders.

In general, borrowers burdened with too much debt and unable to repay their loans can usually discharge them in the event of personal bankruptcy. Certain debts, in particular those due to the State, are not dischargeable. But consumer loans and credit card debt are generally dischargeable. Before 2005, young people who were inundated with student loans from private lenders could get relief by filing for bankruptcy. Even government student loans were dischargeable before 1976, although this was later changed.

The advantage of bankruptcy for the debtor is that the slate is wiped clean. But there is a major downside to bankruptcy: your credit rating is dented. You’re a proven bad risk, and if lenders do business with you in the future, they’ll likely demand high interest rates or substantial collateral, or both. But that’s how it should be: you shouldn’t be able to evade your debts and stiffen your creditors without any consequences. The fear of being labeled a bad risk is a healthy incentive not to borrow too much or pay off if you can.

Biden protects the banks

These were the normal rules and incentives before Biden led a group of 18 Democratic senators to back bankruptcy law changes in 2005. One of those changes prevented most student debtors from being able to repay their private loans. (Congress left a small loophole for some student borrowers, but it was not accessible to the vast majority.) Biden was an enthusiastic supporter of the legislation, voting for it four times before its final passage in 2005.

This type of protection for lenders is exceptional; in general, private consumption debt can be discharged. The legislation Biden wanted was a sweetheart deal for banks that removed student loans from bankruptcy protections. And that led to a train wreck: the students borrowed too much, couldn’t find the kind of jobs that would allow them to repay their loans, and began to cave under pressure. Student debt tripled in the decade after 2005; more than a million people failed to honor their student loans each year.

Worst off were student borrowers who had been sucked into colleges whose programs couldn’t lead to good jobs and who had dropped out of college in debt to take low-paying jobs at Starbucks.

Biden’s debts to financiers

Why did Biden strongly support this change – even as Democrats like Teddy Kennedy denounced him for “sacrifice[ing] Americans to the credit card industry’s rampant greed? Because Biden was a longtime water carrier for the credit card and banking industries. And he and his family took advantage of this arrangement.

Biden has long had mutually rewarding ties to the financial services industry (as have many in his cabinet and others in his inner circle). During the 2003-2008 Senate election cycle, Biden received more than $500,000 from credit card companies, financial services and banks. For decades, he was particularly close to credit card company MBNA (now part of Bank of America) – so much so that he felt compelled to say in 1999, “I’m not the MBNA senator. Like so many other things Biden said, it was wrong.

For more than 20 years, MBNA has been Biden’s biggest contributor. MBNA hired Hunter Biden straight out of law school, made him an executive, and retained his services for five years after he left — for an undisclosed sum — as a “consultant.” So during the years when Biden supported and voted for a bill that enriched corporate lenders and screwed up student borrowers, Hunter was still on MBNA’s payroll.

The judgment came 17 years later. As president, Biden had to do something about the problem that Biden as a senator had helped create. Hence the gift of 500 billion dollars. And Biden’s loan forgiveness does absolutely nothing to improve matters — in particular, nothing to reduce the exorbitant cost of higher education, or improve its quality, or steer young people into careers that will allow them to build a life. better, benefit from higher incomes, and contribute more to society without going into massive debt.

A better plan

Had Biden considered the public interest, he could have offered Congress a plan that would have allowed student borrowers — whether in debt to the government or private lenders — to discharge their debts in the event of bankruptcy. , at least if they had paid off, say, seven years of loans. This would have brought the student loan program back to something more like its previous version.

Yes, it would have cost the government, i.e. the taxpayers, hundreds of billions, but probably less than the plan it adopted. By requiring the student to have repaid his loan for several years before being able to offload the rest, this would have avoided the worst abuses. This would have created an incentive to continue payments on the loan because bankruptcy hurts the borrower’s credit rating.

So some of those whose Biden program has benefited — likely those best able to meet their payments — probably wouldn’t have chosen bankruptcy. On the other hand, the most troubled borrowers would have taken advantage of the opportunity. And if Congress had passed these changes, their legality would have been unassailable. But no, it could have harmed the banks. So, rather than try to fix his past mistakes, Biden chose the quick and dirty but less effective solution.

![[Press release] Debt crisis: a failed G20 summit](https://www.cadtm.org/local/cache-vignettes/L710xH373/f0bd231bf33e0619051e008da75a42-274d7.jpg)

Unlock comments by joining the Federalist community.

Subscribe