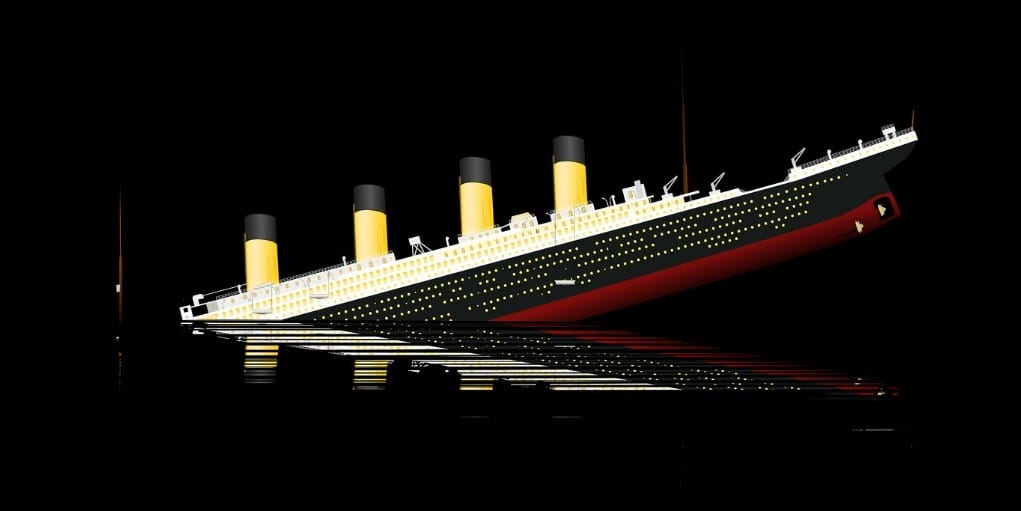

[Press release] Debt crisis: a failed G20 summit

![[Press release] Debt crisis: a failed G20 summit](https://www.cadtm.org/local/cache-vignettes/L710xH373/f0bd231bf33e0619051e008da75a42-274d7.jpg)

Northern industrial powers and international institutions are more concerned with financial stability, fiscal sustainability and supply chains than with the living conditions of the majority of the world’s population.

Unsurprisingly, the result is that the industrial powers of the North and international institutions are more concerned with financial stability, fiscal sustainability and supply chains than with the living conditions of the majority of the world’s population. the G20

G20

The Group of Twenty (G20 or G-20) is a group made up of nineteen countries and the European Union whose ministers, central bank directors and heads of state meet regularly. It was created in 1999 after the series of financial crises of the 1990s. Its objective is to promote international consultation on the principle of broadening the dialogue according to the growing economic importance of a certain number of countries. Its members are Argentina, Australia, Brazil, Canada, China, France, Germany, Italy, India, Indonesia, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, the United States, the United Kingdom and the European Union (represented by the Presidents of the Council and of the European Central Bank).

, the WTO

WTO

World organization of commerce

The WTO, founded on 1st January 1995, replaced the General Agreement on Trade and Tariffs (GATT). The main innovation is that the WTO has the status of an international organization. Its role is to ensure that no member state adopts any form of protectionism, in order to accelerate the liberalization of world trade and facilitate the strategies of multinationals. It has an international tribunal (the Dispute Settlement Body) which judges any alleged violation of its founding text drafted in Marrakech.

, the world Bank

world Bank

BM

The World Bank was founded within the framework of the new international monetary system put in place at Bretton Woods in 1944. Its capital is provided by contributions and loans from member states on the international monetary markets. It has funded public and private projects in Third World and Eastern European countries.

It is made up of several closely associated institutions, among which:

1. The International Bank for Reconstruction and Development (IBRD, 189 members in 2017), which grants loans in productive sectors such as agriculture or energy;

2. The International Development Association (IDA, 159 members in 1997), which grants the least developed countries long-term loans (35-40 years) at very low interest rates (1%);

3. The International Finance Corporation (IFC), which provides both loans and equity financing to business enterprises in developing countries.

As Third World debt gets worse, the World Bank (along with the IMF) tends to take a macro perspective. For example, it applies adjustment policies aimed at balancing the payments of heavily indebted countries. The World Bank advises countries that need to undergo IMF therapy on issues such as how to reduce budget deficits, pool savings, encourage foreign investors to locate within their borders, or to free up prices and exchange rates.

and the IMF

IMF

International Monetary Fund

With the World Bank, the IMF was founded on the day of the signing of the Bretton Woods agreements. Its first mission was to support the new standard exchange rate system.

When the Bretton Wood system of fixed rates ended in 1971, the main function of the IMF became that of being both the policeman and the firefighter of world capital: it acts as a policeman when it carries out its policies. structural adjustment and as a firefighter when intervening. to help governments with default on debt.

As for the World Bank, a weighted voting system works: according to the amount paid as a contribution by each member state. 85% of the vote is needed to change the IMF charter (meaning the United States with 17.68% of the vote has a de facto veto right over any change).

The institution is dominated by five countries: the United States (16.74%), Japan (6.23%), Germany (5.81%), France (4.29%) and the United Kingdom -United (4.29%).

The other 183 member countries are divided into country-led groups. The most important (6.57% of the vote) is led by Belgium. The smallest group of countries (1.55% of the vote) is led by Gabon and includes African countries.

http://imf.org still refuses requests for patent suspensions, free universal vaccination and massive investments in public health systems. However, to date, the social and health situation of the working classes most affected by the crisis resulting from the pandemic is deteriorating at an alarming rate. The debt crisis of countries in the South, especially low and middle income countries, further worsens their political, food and economic dependence. Employees and small producers are the ones who have to pay the debt.

The World Bank, IMF, G20 and Parisian club

Parisian club

This group of lending states was founded in 1956 and specializes in handling non-payments from developing countries.

countries have all launched initiatives to respond to the debt crisis. These attempts are all most unsatisfactory: the Debt service

Debt service

The sum of interest and amortization of borrowed capital.

The Suspension Initiative (DSSI) and the Common Framework (CF) have only pushed the issue back. More than a third of the 73 countries invited to participate in the DSSI declined the offer for fear of being discredited by rating agencies

Rating agency

Rating agencies

Rating agencies, or rating agencies, assess creditworthiness. This includes the creditworthiness of companies, nonprofits and governments, as well as “securitized assets” – which are assets that are bundled together and sold to investors as collateral. Rating agencies assign a rating to each bond, which represents an opinion as to the likelihood that the organization will be able to repay both principal and interest as they fall due. Ratings are made on a decreasing scale: AAA is the highest, then AA, A, BBB, BB, B, etc. A BB rating or lower is considered an “unwanted bond” because it is susceptible to default. There are many factors that go into assigning ratings, including the profitability of the organization and its total debt load. The three largest credit rating agencies are Moody’s, Standard & Poor’s and Fitch Ratings (FT).

Moody’s: https://www.fitchratings.com/ and international financial markets, and be subject to a new wave of austerity measures by the IMF. The common framework is even more of a failure; this initiative was supposed to extend the DSSI to private actors, who are the main creditors of these countries (up to 60%). Only 0.2% of debt service owed to private creditors has been suspended and only Ethiopia, Chad and Zambia have called on the CF to renegotiate their debt, so far to no avail. In short, for the 46 countries concerned by the DSSI and the FC, less than a quarter of the debt service (10.9 billion dollars) has been suspended. [1] More than a third of countries in the South have suspended reimbursement or are on the verge of doing so. September 15 UNCTAD

UNCTAD

United Nations Conference on Trade and Development

This was created in 1964, under pressure from developing countries, to offset the effects of GATT.

said “the sustainability of the external debt of developing countries has deteriorated further” and called for “concerted debt relief, or even cancellation in some cases”, to reduce the debt overhang of developing countries and avoid another lost decade. [2] On October 11, the WB highlighted the record level of debt in low-income countries and an increase of more than 5% in debt in developing countries. [3]

The CADTM calls once again for the replacement of these institutions and the formation of a united front of the countries of the South to decide on an immediate suspension of the debt service on the basis of the state of necessity and of a fundamental change of circumstances

The outcome of the G20 summit, which brings together the countries that govern the world in the interest of Capital, clearly shows that no initiative in favor of the debtor countries of the South will be taken to enable them to face the emergency and to achieve the Sustainable Development Goals by 2030, however modest they may be. On the contrary, the only measures adopted aim to guarantee the repayment of the debt to the banks of the North and to private creditors.

The CADTM calls once again for the replacement of these institutions and the formation of a united front of the countries of the South to decide on an immediate suspension of the debt service on the basis of the state of necessity and a change. fundamental of circumstances. In addition, a debt audit with citizen participation is required to identify illegitimate, illegal, odious and unsustainable debts with a view to their cancellation.