“They bought a car without brakes”

ALBANY — Is the nation’s student debt crisis the result of a bad borrower problem or a bad lending system?

That was the question driving Albany filmmaker Mike Camoin’s latest project.

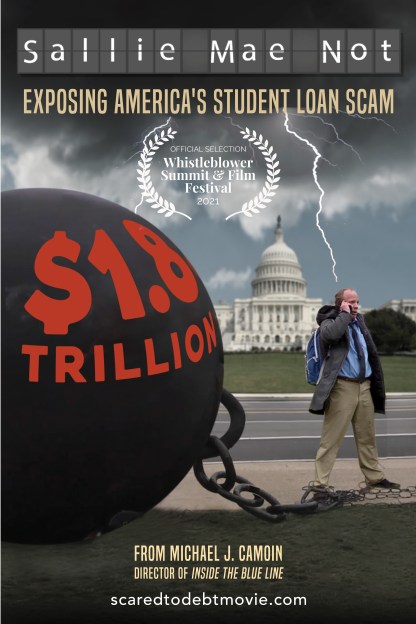

“Sallie Mae Not” premieres virtually at 1 p.m. on Monday, July 26 at the Whistleblower Summit and Film Festival. This is the first chapter in Camoin’s six-part “Scared to Debt” series, which explores how US student loan debt rose from $10 billion in 1986 to $1.6 trillion.

The film festival, which this year is a “Tribute to the 50th Anniversary of the Pentagon Papers and the Rise of Investigative Journalism”, is organized by ACORN 8 and the Society of Professional Journalists, Washington DC Chapter. ACORN 8 is a watchdog organization of former Association of Community Organizations for Reform Now insiders and national board members who attempted to reform ACORN after the discovery of a multi-million dollar embezzlement.

The film festival runs from July 23 to August 1.

For Camoin, his documentary is personal. Next year, her 17-year-old daughter will be a senior in high school and will start applying to colleges. He also has a 15-year-old son who is entering Grade 11.

“I started talking to friends of mine about student loans and realized it was really impacting so many people I know. As a parent, I would soon be faced with this really bad choice to finance university,” he said. t want to take out these loans; I know too much.”

A graduate of St. Bonaventure University and the University of Albany, the former Slingerlands social worker started his company Videos For Change Productions 25 years ago and has made documentary filmmaking a full-time career. His 1998 production “Inside The Blue Line: Leadley’s Legacy,” a series centered on an Adirondack lumberjack’s quest to save nature, aired on PBS and Canadian television.

Camoin’s latest film brings voice to student borrowers, financial experts and early whistleblowers who say they weren’t taken seriously when they warned of a systematic dismantling of basic consumer protections for student borrowers, which began in 1998. The result is a predatory lending system that exploits millions of young people and their families.

It features Rolling Stones columnist Matt Taibbi, who sounded the alarm on the student loan industry in 2013, when Sallie Mae Bank, a formerly federally backed lender, went entirely private.

“Everyone in the education sector deals with the misery of young people who make dire financial decisions when they’re just teenagers,” Taibbi says in the trailer.

The series targets banks, government and college leaders. It links the under-regulated student loan system to skyrocketing tuition fees at institutions across the United States. The average cost of tuition and fees for the 2020-2021 school year was $41,411 at private colleges, $11,171 for in-state residents at public colleges, and $26,809 for foreign students in public schools, according to data from US News & World Report.

Camoin also speaks with Catherine Fitts, a former housing official for President George HW Bush who spent years working in finance. She served on the board of Sallie Mae from 1991 to 1993, before its privatization.

She describes a concerted effort by banks to remove basic protections for student borrowers, which effectively created a credit bubble.

“From an ethical standpoint and from a societal standpoint, you’re going from a legitimate operation or business to being a scam,” Fitts said.

The voice of Alan Collinge, founder of StudentLoanJustice.Org and author of “The Student Loan Scam”, originated the attachment. Collinge is a scientist-turned-activist who said he was wrongfully faulted by Sallie Mae. Collinge warned of the loan “plan” in 2006 on 60 Minutes, which he said drove students and their families to a financial cliff.

Camoin talks to borrowers who have been making regular payments for decades, but because of interest rates and fees – which start accumulating the day they sign the papers – have barely reduced the principal. Many people in their 30s realize they won’t reach the loan principal in their lifetime, Camoin said.

“Who tipped them off what they were getting into? Time after time they get very little or no financial advice,” he said. “It’s the most expensive decision of their lives.”

Through an online fundraiser, Camoin has already raised about half of his goal of $350,000, funds that will help him complete the series.

The film stops short of advocating a single solution. Progressive advocates like Collinge are calling on the federal government to cancel all federal student loans and restore bankruptcy protection for student borrowers.

Camoin said his approach is to “give voice to the voiceless” and encourage the discovery of non-partisan solutions. He warns that when students realize they have been ‘ripped off’ by private lenders, it will spark a ‘debt revolt’.

“Once they find out they bought a car with no brakes, they won’t want to pay those loans back,” Camoin said.

![[Press release] Debt crisis: a failed G20 summit](https://www.cadtm.org/local/cache-vignettes/L710xH373/f0bd231bf33e0619051e008da75a42-274d7.jpg)