The loans have been agreed but not yet distributed and are part of $2 billion in undisbursed loans canceled by Lusaka

Bilateral lenders have also agreed to provide debt relief, showing the ‘potential of the G20 common framework for debt treatment’, according to the IMF

Zambia canceled $1.6 billion in agreed but undisbursed Chinese loans, mainly from China Exim Bank and the Industrial Commercial Bank of China, to help manage its debt problems.

It is part of the $2 billion that Lusaka canceled in undisbursed loans from its external creditors, shortly before its official bilateral lenders agreed on Saturday to provide debt relief to the southern African nation.

Lusaka announced that it had halted construction and rehabilitation of several roads, highways and information and technology projects, most funded by China Exim Bank, after encountering difficulties repaying its loans.

“Steps have been taken by the Government of the Republic of Zambia to address the current debt challenges – beyond the process of debt restructuring. to halt certain loan-funded projects,” Zambia’s Ministry of Finance and National Planning announced on Saturday.

In addition, he said that a few critical projects would be redefined to allow critical components to be completed using the budget resources allocated in the medium term.

The ministry said it has started talks with creditors and contractors to formalize the cancellation of works contracts.

Among the canceled projects is the rehabilitation of a major highway – the $1.2 billion Lusaka-Ndola dual carriageway funded by China Jiangxi Corporation – which was to link the capital to the country’s Copperbelt province. Lusaka asked China Jiangxi to cancel $157 million in undisbursed loans.

Digital projects, such as Smart Zambia Phase II and the Digital Terrestrial Television Broadcast Systems in Zambia Phases II and III, have also been halted as the country struggles to avoid a debt crisis.

Zambia said it had notified Chinese lenders and contractors of its intention to write off undisbursed loan balances for 14 projects.

This will involve stopping the disbursement of US$333.2 million for Phase II of Smart Zambia, which was implemented by Huawei Technologies and funded by China Exim Bank.

The initial phase of the project was to build a national data center and an ICT talent training center. Huawei was to develop Zambia’s national broadband system to strengthen public service delivery in subsequent phases.

The country has also asked the China Exim Bank to cancel US$159 million intended to finance the construction of the Chalala army barracks in Lusaka.

Besides the Chinese loans, Zambia also plans to cancel loans advanced by the British Standard Chartered Bank for the construction of the Kafulafuta dam for $381.7 million, of which $224.6 million had already been disbursed. The other is a multi-million dollar deal involving the Israel Discount Bank to finance military aircraft and equipment.

In 2020, Zambia became the first African country to default during the pandemic when it failed to repay $17 billion in external debt, including $3 billion in dollar-denominated bonds. Lusaka owes Chinese lenders about $6 billion, which has been spent on building megaprojects including airports, highways and power dams.

In addition to canceling contracts and halting loan disbursements, Lusaka received a reprieve after official creditors led by China and France agreed to provide debt relief. The decision paves the way for the country’s access to a $1.4 billion rescue package from the International Monetary Fund. Yet Lusaka must seek similar relief from private creditors for the $3 billion it owes Eurobond holders.

He had requested debt relief from the Group of 20 richest countries and its major private creditors under the new G20 Common Framework to help more than 70 developing countries restructure and relieve their post-Covid debt. The process allows creditors to jointly renegotiate its external debt – although China generally prefers bilateral negotiations.

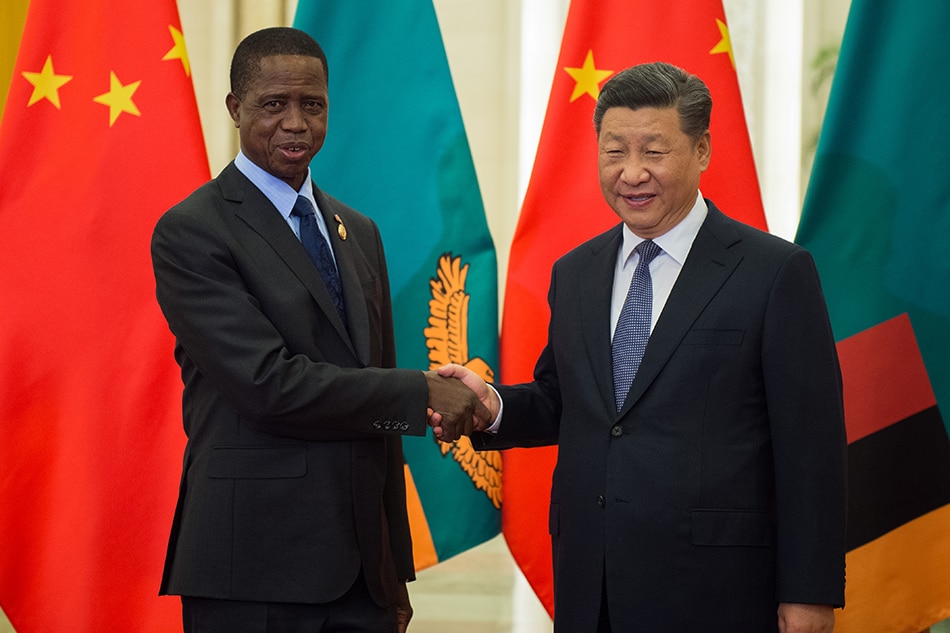

Zambia’s committee of official creditors – co-chaired by China and France with South Africa serving as vice-chair and comprising IMF and World Bank staff – met on July 18 and committed to providing debt relief to Zambia.

IMF Managing Director Kristalina Georgieva welcomed the decision by official creditors to provide financial guarantees, paving the way for a fund program, saying it showed “the potential of the G20 common framework for debt treatment at offer to countries determined to solve their debt problems”. .

“Delivery of these financing assurances will enable the IMF Executive Board to consider approval of a Fund-supported program for Zambia and unlock much-needed financing from Zambia’s development partners,” said Georgiava.

“Amid high debt levels and tighter financial conditions, I look forward to seeing the Common Framework work for other countries facing debt challenges.”

Zambian Finance Minister Situmbeko Musokotwane said the country would “continue to work with public and private creditors to agree on the terms of the debt restructuring in accordance with the principle of comparability of treatment”.

The common framework aims to help countries weather the Covid-19 storm with debt relief and restructuring, but besides Zambia, only Ethiopia and Chad have applied to join the plan, with most countries fearing that ‘in seeking relief, their credit rating will not be downgraded by the rating. agencies.

Copyright (c) 2022. South China Morning Post Publishers Ltd. All rights reserved.

INTEGRATED AS IVS

https://www.youtube.com/watch?v=agOEOvI5ZCc&t=89s

![[Press release] Debt crisis: a failed G20 summit](https://www.cadtm.org/local/cache-vignettes/L710xH373/f0bd231bf33e0619051e008da75a42-274d7.jpg)