Canada is ‘pretty close’ to a debt crisis, Magna founder Frank Stronach warns

calls for legislation that would prevent governments from spending more than they collect in taxes

Content of the article

Frank Stronach, founder of one of Canada’s largest global companies, says the country is “pretty close” to a public debt crisis and Canadians need to force politicians to limit their spending.

Content of the article

The Magna International Inc founder was speaking to BNN Bloomberg on Wednesday after writing an op-ed for the National Post this week.

When asked how close Canada was to a debt crisis similar to the one that threatened the country in the 1990s, Stronach replied, “I think it’s pretty close, you know, our debt is growing by about 400 million dollars every day, isn’t it? So that should be a big concern.

In his op-ed, Stronach wrote that Canada is not immune to the slide into bankruptcy seen by other countries like Argentina and Greece.

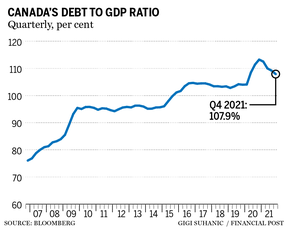

“On the contrary, at the rate we are going, we are getting closer and closer to this scenario. Canada’s debt-to-GDP ratio in 2021 was around 109%, the same percentage as Greece’s just a few years before its bailout. In other words, the amount of money Canada owes is greater than the amount we produce in goods and services. It’s never a good sign,” he wrote.

Content of the article

He asks Canadians to push for legislation that would prevent governments from spending more revenue than they can collect in taxes.

The alternative is an economic collapse that will hit the lower and middle classes hardest as the government is forced to cut social benefits, he wrote.

“Every citizen can feel deep within that the nation’s growing mountain of debt is a problem,” Stronach wrote in the National Post.

“Our political leaders are pushing us deeper and deeper into debt and we are getting to the point where we may never be able to repay the debt we owe. It is high time that we force our political leaders to stop spending more than they get.

![[Press release] Debt crisis: a failed G20 summit](https://www.cadtm.org/local/cache-vignettes/L710xH373/f0bd231bf33e0619051e008da75a42-274d7.jpg)